401k Employer Contribution Limits 2019

However keep in mind that certain employers may place their own limit on how much staff can invest in an employer-run 401k account. The all sources maximum contribution employee and employer combined rose to 56000.

2019 Solo 401k Contribution Deadlines My Solo 401k Financial

2019 Solo 401k Contribution Deadlines My Solo 401k Financial

Call us learn more.

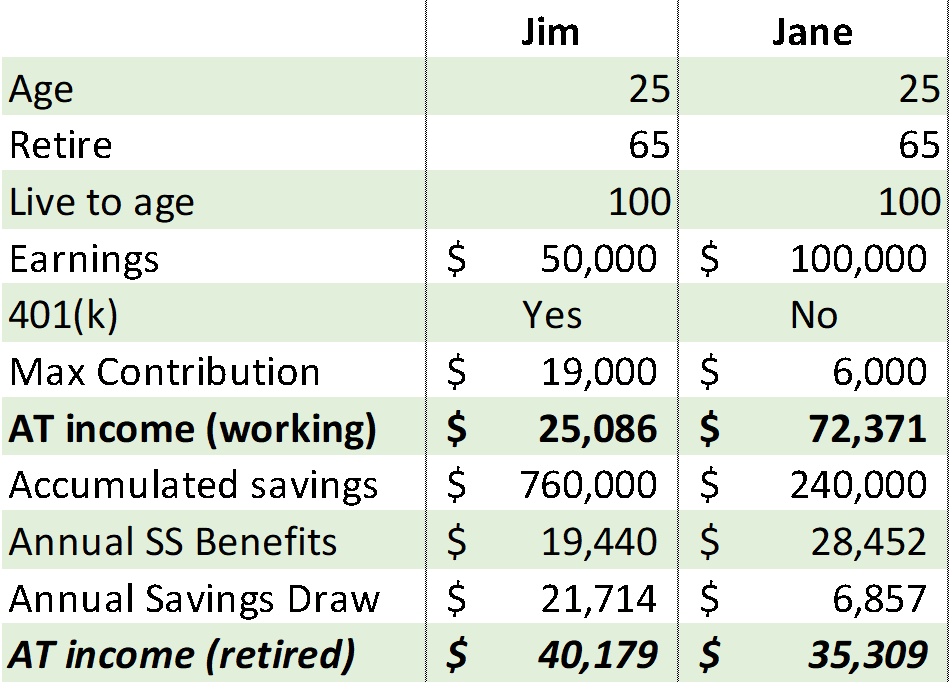

401k employer contribution limits 2019. The main attraction of 401 k plans is the amount you can contribute. The contribution limit for employees who participate in 401 k 403 b most 457 plans and the federal governments Thrift Savings Plan is increased from 18500 to 19000. Your employers maximum 401K contribution limit is entirely up to them but the max on total contributions employee plus employer to your 401K is 58000 in 2021 or 100 of your salary whichever is less.

If youre wondering about the employer and employee contribution limits it will increase 1000 in 2019 to 56000. The limit on annual contributions to an IRA which last increased in 2013 is increased from 5500 to 6000. Call us learn more.

That adds another 6500 to the contribution. The 2019 contribution limit for 401k plans is 19000 which means that you can technically defer all of your salary if it means that your contributions will still remain less than the 19000 limit. You can contribute up to 19500 to your 401 k in 2020 and 2021 or 26000 if youre age 50 or over.

Any employer match that you receive does not count toward this limit. Highlights of Changes for 2019. You can withdraw your entire US 401k IRA Tax Free using Tax Treaty.

For 2019 employees and self-employed individuals who open Solo 401 k plans can contribute 100 percent of their pay or net self-employment earnings up to. Ad US retirement funds withdrawal can be tax-free in the US for Non Resident Alien 401k IRA. You can withdraw your entire US 401k IRA Tax Free using Tax Treaty.

13500 in 2021 and 2020 13000 in 2019 This amount may be increased in future years for cost-of-living PDF adjustments. You dont pay taxes on matching contributions until you withdraw them in retirement. For 2021 the maximum allowed contribution to a 401 k is 19500 per year.

However elective salary deferrals made by employees are limited to 19500 in 2020 and 2021 up from 19000 in. For 2021 the contribution limit is 19500. For 2019 401k Contribution Limit for Employees Rises to 19000 Catch-up contribution for those 50 and older stays at 6000 while contribution limit from all sources hits 56000.

Ad US retirement funds withdrawal can be tax-free in the US for Non Resident Alien 401k IRA. For 2019 that limit stands at 56000. While an employers 401 k match and non-matching contributions dont count toward your 19500 employee deductible contribution limit 26000 if you are 50 or older they are capped by total.

You can also make a catch up contribution if youre 50 or older. In 2019 the contribution maximum rose to 19000 per employee. If you contribute the max of 19000 your employer can contribute up to 37000 for 2019.

The IRS maximum 401K contribution is how much you can personally contribute to your 401K during a calendar year. The combined amount contributed by employer and employee is 58000 for 2021 57000 for 2020. There is a cap on.

For the 2021 plan year an employee who earns more than 130000 in 2020 is an HCE. If your employer has a matching contribution it turns into. This means that together you and your employer can contribute up to 56000 for your 401 k.

The limit on employee elective deferrals to a SIMPLE 401 k plan is. However if youre considered a highly compensated employee or HCE. For 2020 you and your employer can contribute up to 57000.

The chart below provides a breakdown of the rules and limits for defined contribution plans 401 k 403 b and most 457 plans For the 2020 plan year an employee who earns more than 125000 in 2019 is an HCE.

401 K Contribution Limits 2020 What Employers Need To Know

401 K Contribution Limits 2020 What Employers Need To Know

Understanding 401k Contribution Limits Retire

The Irs Announced Higher 401k And Ira Contribution Limits For 2019 How Much Should You Save Sensible Financial Planning

The Irs Announced Higher 401k And Ira Contribution Limits For 2019 How Much Should You Save Sensible Financial Planning

401k 403b Tsp Historical Contribution Limits 2009 2019 My Money Blog

401k 403b Tsp Historical Contribution Limits 2009 2019 My Money Blog

Irs Plans To Bump Up 401k Contribution Limit For 2019 Tsg Financial

Tax Deductions And Retirement Limits For 2019 You Should Be Familiar With The Legend Group

Tax Deductions And Retirement Limits For 2019 You Should Be Familiar With The Legend Group

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

2019 Ira Contribution Limits Unchanged For 2020 401k And Hsa Caps Rise Investor S Business Daily

2019 Ira Contribution Limits Unchanged For 2020 401k And Hsa Caps Rise Investor S Business Daily

What S The Maximum 401k Contribution Limit In 2019 Mintlife Blog

What S The Maximum 401k Contribution Limit In 2019 Mintlife Blog

Retirement Plan Contribution Limits Will Increase In 2020 Ward And Smith P A Jdsupra

Retirement Plan Contribution Limits Will Increase In 2020 Ward And Smith P A Jdsupra

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500

What S The Maximum 401k Contribution Limit In 2019 Mintlife Blog

What S The Maximum 401k Contribution Limit In 2019 Mintlife Blog

2020 Irs Contribution Limits For Retirement Plans Fiduciary Financial Partners

2020 Irs Contribution Limits For Retirement Plans Fiduciary Financial Partners

401 K Maximum Employee Contribution Limit 2020 19 500

401 K Maximum Employee Contribution Limit 2020 19 500

Comments

Post a Comment