Suntrust Home Equity Loan

The SunTrust Equity Line of Credit offers a special variable rate of Prime - 126 currently 324 APR 1 for twelve months on an initial advance of 25000 or more taken at the closing of the line of credit under the variable rate option. The biggest advantage that a SunTrust home equity line of credit offers is the ability for borrowers to quickly pay off debts or expenses as they arise.

Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

For promotional balances remaining at the end of the Special Rate Period as well as all subsequent advances under this option interest will accrue at the.

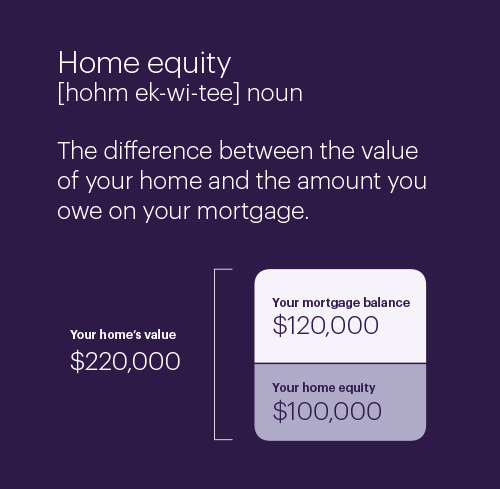

Suntrust home equity loan. And if required title insurance and related fees and any new or. SunTrust HELOCs can range from 10000 to 500000 and have a 10-year draw period and a 20-year. Your equity is your propertys value minus the amount of any existing mortgage on the property.

However they do not offer home equity loans which makes it hard to place them among the best lenders we reviewed. Remember the APRs of home equity loans do not include points and financing charges just the interest rate. What are the home equity.

Compare a Home Equity Line of Credit and a Cash-Out Refinance. 2 For new consumer home equity lines of credit of 10000 or more SunTrust will advance certain costs on your behalf including the first propertycollateral valuation obtained by SunTrust but excluding. SunTrust Bank Home Equity Loans allows borrowers to apply for home equity loans of up to 500000.

Borrowers can use their funds to pay medical or dental bills education-related expenses automotive expenses or home improvements. Suntrust is one of the largest banks in the country and their home equity options make them a good lender if you are interested in a home equity line of credit. Borrowing against your equity can be set up as a loan home equity loanwhere you receive one lump sum and repay it with interest over timeor a.

A SunTrust HELOC offers a variety of options. 1 SunTrust Equity Line. With a HELOC homeowners may borrow against their home equity as needed.

2 days ago SunTrust Bank Home Equity Loans offers home equity loans with a fixed APR that ranges from 325 up to 18. Suntrust home equity loan rates do not exist seeing as home equity loans are not offered by them so here is a general breakdown of how these rates typically look. SunTrust now a part of Truist Financial Corp offers a variety of home loan options but you have to start an application to get personalized mortgage rates online.

Use your home to improve your home. The bottom line. A home equity loan HEL is a type of loan in which you use the equity of your property Suntrust Bank Home Equity Loan Rates or a portion of the equity thereof as collateral.

Your home is likely your biggest investment and a source of both pride and financial confidence. The interest rate charged by most home equity loans is usually slightly higher than the rate charged by first mortgages and it is usually linked to a major financial index like the Prime Rate which is published. The actual maximum loan amount will vary depending on the value of the property how much you owe on it and your creditworthiness.

An equity line of credit is a powerful financial tool that allows you to meet a variety of planned or unplanned needs. What is the estimated funding time for a home loan via SunTrust Bank Home Equity Loans. What Is A Suntrust Home Equity Loan Wiz 2018 U S Home Equity Line Of Credit Satisfaction Study J D Power Tips To Help Financial Marketers Get More Home Equity.

The SunTrust Home Equity Line of Credit is a convenient way to access the equity youve built up in your largest asset your home said Mark Ford Head of Personal Lending and Card Solutions at SunTrust Bank. Suntrust Home Equity Loans Rates Reviews And Requirements Reasons For And Against A Home Equity Line Of Credit Nerdwallet Burned In 2008 Americans Are Refusing To Tap Their Home Equity. Any subsequent propertycollateral valuation not required by us.

Minimum required line amount for this interest rate is 100000 and is based on a maximum Combined Loan-To-Value CLTV ratio of 70 or less. Loan products offered SunTrust Banks only home equity product is its home equity line of credit. The SunTrust home equity loan allows homeowners to borrow a single lump sum to be repaid over a set period of time at a fixed interest rate.

The Prime Rate means the highest per annum Prime Rate of interest published from time to time by The Wall Street Journal in its Money Rates listings which was 325 on 212021. At SunTrust were dedicated to providing homeowners like you with the tools support and expert guidance to make confident financial decisions.

Home Equity Loan Suntrust Home Equity Loan

Home Equity Loan Suntrust Home Equity Loan

3 Smart Ways To Use Home Equity Truist Money And Mindset

3 Smart Ways To Use Home Equity Truist Money And Mindset

Suntrust Bank 2021 Home Equity Review Bankrate

Suntrust Bank 2021 Home Equity Review Bankrate

Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

Suntrust Bank Home Equity Loans Reviews Mar 2021 Home Equity Loans Supermoney

Suntrust Bank Home Equity Loans Reviews Mar 2021 Home Equity Loans Supermoney

Home Improvement Loans Suntrust Loans

Home Improvement Loans Suntrust Loans

What Is A Suntrust Home Equity Loan Home Equity Wiz

What Is A Suntrust Home Equity Loan Home Equity Wiz

Suntrust Home Equity Line Of Credit

Suntrust Home Equity Line Of Credit

![]() Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

Home Equity Line Of Credit Heloc Suntrust Loans

Comments

Post a Comment