Net To Gross Formula Excel

Its not a simple 122 increase which would equal gross 12200. The gross profit equation is as follows.

How To Calculate Your Net Salary Using Excel Salary Ads Excel

How To Calculate Your Net Salary Using Excel Salary Ads Excel

This is called the gross profit.

Net to gross formula excel. Revenue Cost Gross profit. What is the gross profit formula. The gross profit formula is a simple equation with big implications for your business.

Useful How To Calculate Gross Profit In Excel video from Activia Training. As mentioned above we will use the in-built Round function and to ensure the code works with both Excel 97 and Excel 2000 we will use the full syntax as shown below. I am lost here usually you have your gross less your taxes Your net assuming gross is in a1 tax in b1calculated based on 10 taxes in c1 the net will be a1-b1 Now if you know your net to get your gross will be c1090 090 comes from 1-010 taxes placerpone wrote.

Use your usual software to find two gross pay values giving net pay values that straddle the one supplied and use linear interpolation. Because when you take a gross distribution of 12200 with 22 2684 for taxes you get a net distribution of 9516 NOT. The formula below calculates the number above the fraction line.

In this case Excel first calculates the result of 1 - the value in D6 2 to get 08. E10F10 e10 being an amount of money and f10 being a percentage fo it I am needing the resulting answer to round up or down to the nearest 100. Total Revenue - COGS.

The current formula is ie. Write down the net income. Frequent budget adjustments when the gross amount of the adjustment is know.

For example here are a set of marginal rates there is no tax below 10320 and suppose my net income was 58432. Gross Profit is calculated using the formula given below Gross Profit Net Sales. X Y-axb-cxd1-b-d where x gross pay y net pay a NI threshold b NI rate c Tax free threshold d tax rate Ive tried it out using a few different levels of gross pay and also by varying the rates and thresholds and it seems to work so long as the gross pay.

You can use net to calculate gross if you are given the relationship between the two figures in terms of percentages. 56 1 -. The term net refers to the amount of profit or income after taxes and deductions have been subtracted from the gross total.

So if the answer is below the 50 mark it would round down and above it would round up. Your formula is. I will know the net income and the marginal brackets and rates.

Revenue refers to the amount of money you generated when a client customer or other consumer purchased your product or service from you for. Gross Margin Formula In Absolute Term Net Sales COGS Gross Margin Formula In Percentage Form Net Sales COGS 100 Net Sales. Cant use the normal grossing up formula of 1 Adding up all federal state and local tax rates 2 Subtract the total tax rates from 100 3 Divide net payments by the net percent.

Heres an example. In this situation I would personally use Solver but I need to roll this out to team members who dont have. I need a formula for excel that would allow me to calculate the gross income required to produce a certain net income.

Using this formula any expenses with a VAT rate of 0 will display the same net total and gross total. Net Payment 1 - total taxes Gross Payment because the state tax needs to be rounded to the nearest whole dollar. John wants to receive NET 10000 from his investments with 22 withheld for Federal Taxes what is his GROSS distribution before taxes.

As per the annual reports for the year ending on December 31 2018 the following information is available. For example you might have a net income of 35000 per year. If that is not possible then just rounding down would be acceptable.

The formula of gross margin in numbers and percentage term is as follows. If Gross Net 175 of Net you can think of this as Gross Net x 1175 Then applying a little algebra Net Gross 1175 Dave O Eschew obfuscation. A fairly simple method You can do this in Excel without getting into complicated formula or delving into the tax system.

Next the value in C6 56 which represents the discounted or sale price is divided by 08 to get a final result of 70. Divide this result by the total revenue to calculate the gross profit margin in Excel. I have a simple spreadsheet that calculates Gross Salary to Net by way of first deducting 85 for Insurance then the balancing amount deducted as.

Since dividing any number by 100 ie. Dividing by 1 doesnt change the number we can safely use the formula 1 the value in column B as our calculation as below. 0 - 4000000 0 4000001 - 9000000 5.

Any expenses with a VAT rate of 20 will display the net total minus the VAT. NetToGross ApplicationWorksheetFunctionRoundNet 1 TaxRate 2. This is probably more of a maths question than a Excel onebut here goes.

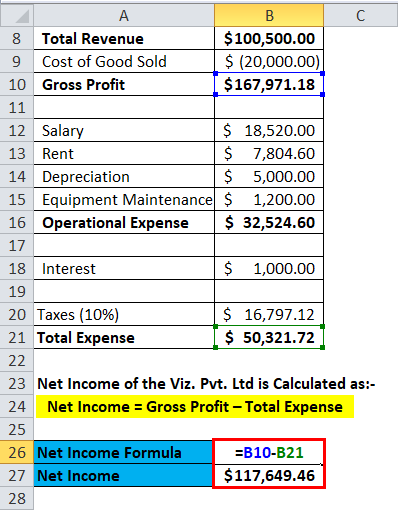

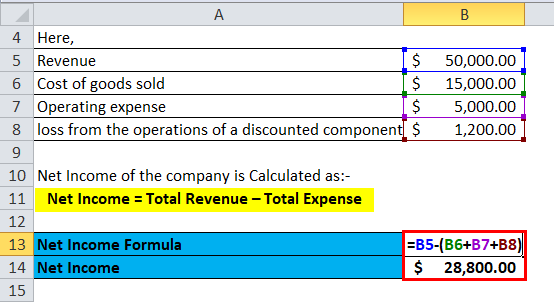

Net Income Formula Calculator With Excel Template

Net Income Formula Calculator With Excel Template

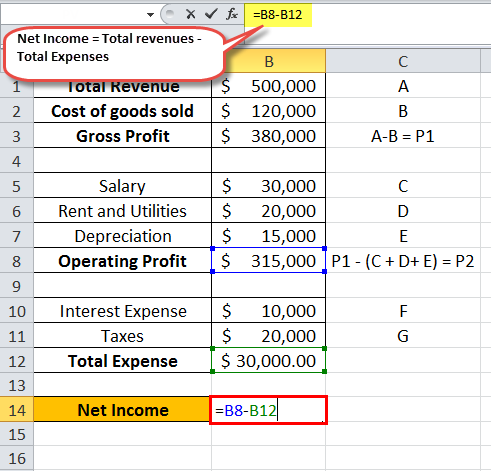

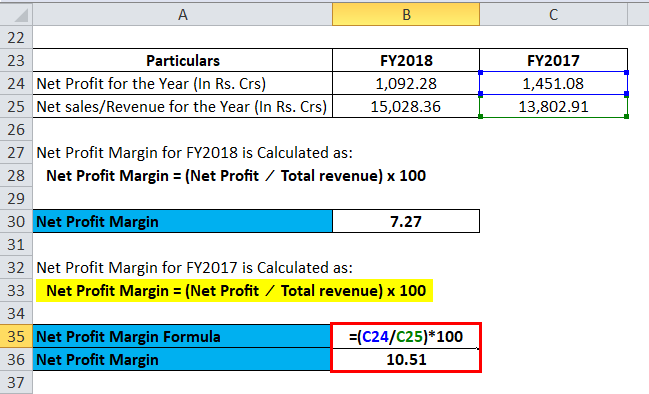

Net Income Formula How To Calculate Net Income Examples

Net Income Formula How To Calculate Net Income Examples

Calculate Vat In Excel Excel Vat Formula Change This Limited

Calculate Vat In Excel Excel Vat Formula Change This Limited

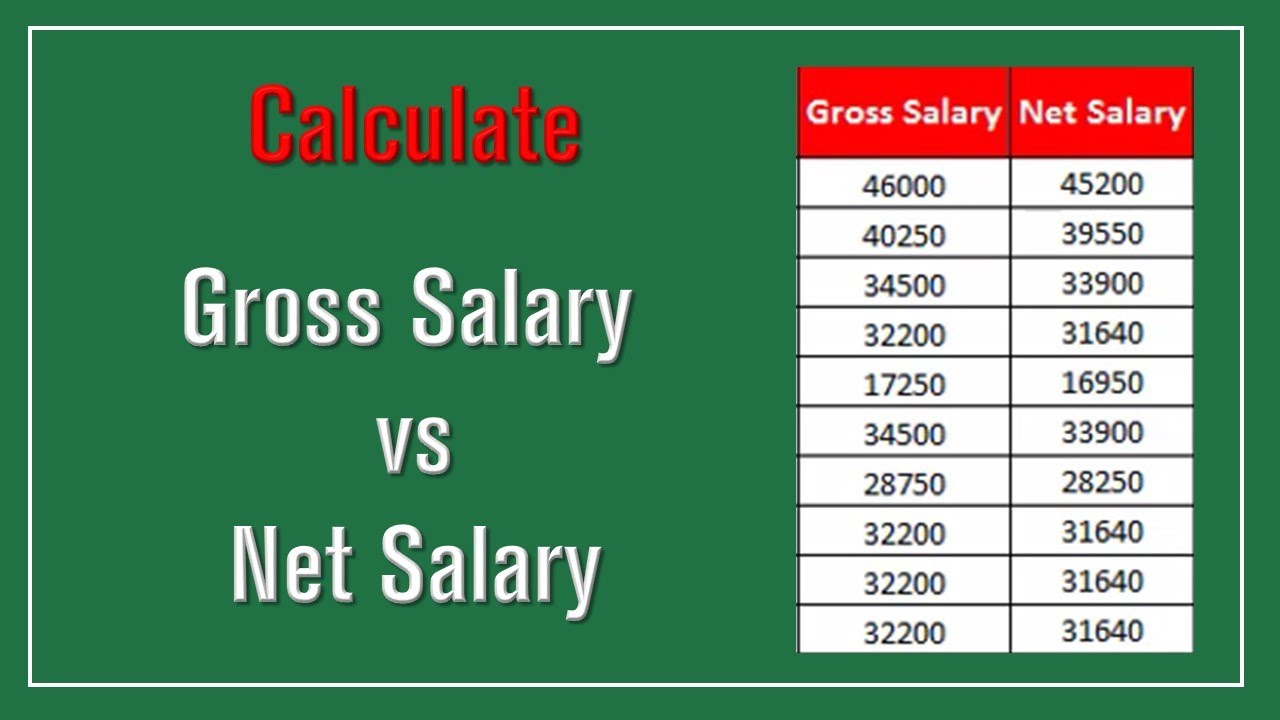

How To Calculate Net Salary Gross Salary In Excel Youtube

How To Calculate Net Salary Gross Salary In Excel Youtube

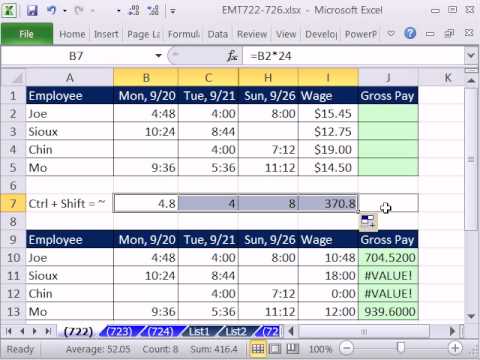

Excel Magic Trick 722 Calculate Gross Pay For Week From Time Values In Range Hourly Wage Youtube

Excel Magic Trick 722 Calculate Gross Pay For Week From Time Values In Range Hourly Wage Youtube

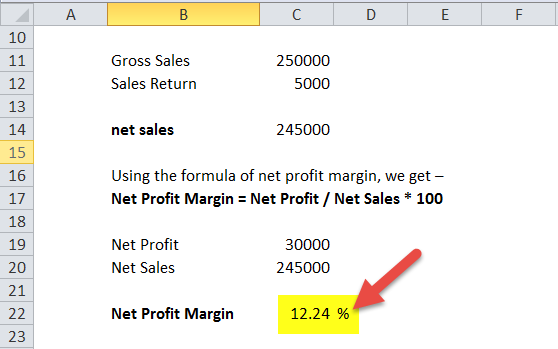

Net Profit Margin Definition Formula How To Calculate

Net Profit Margin Definition Formula How To Calculate

Profit Margin Formula Excel Page 6 Line 17qq Com

Profit Margin Formula Excel Page 6 Line 17qq Com

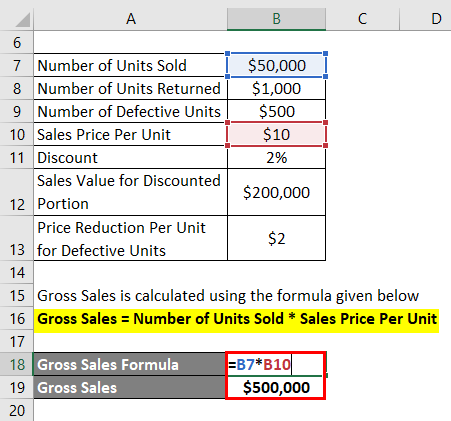

Net Sales Formula Calculator Examples With Excel Template

Net Sales Formula Calculator Examples With Excel Template

Net Income Formula Calculator With Excel Template

Net Income Formula Calculator With Excel Template

What Is The Formula For Calculating Gross Profit Margin In Excel

Net Profit Margin Formula Calculator Excel Template

Net Profit Margin Formula Calculator Excel Template

Comments

Post a Comment