Whats Gross Pay

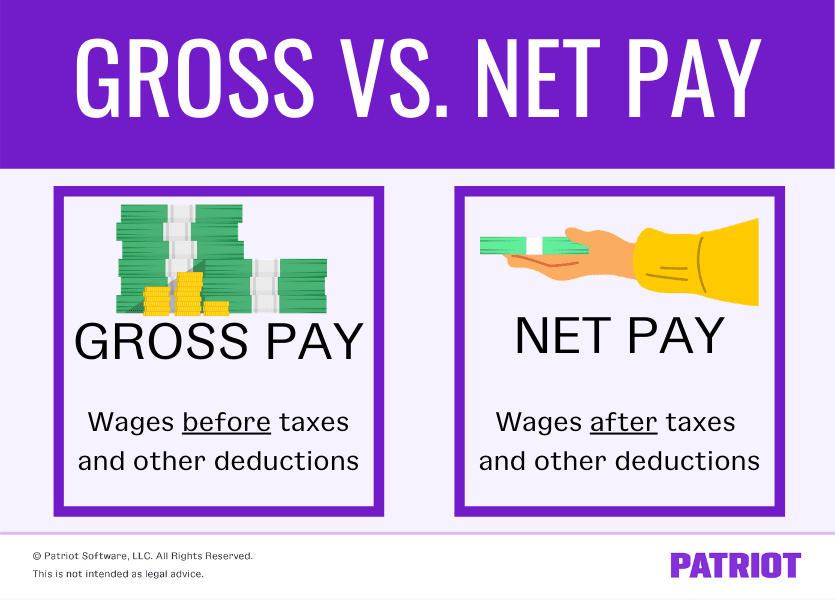

Taxable income is the amount of gross income after subtracting deductions. Gross pay is the amount an employee is paid before the employer withholds FICA Social Security and Medicare payroll taxes income taxes federal state local if applicable and other amounts such as wage garnishments insurance payments union dues savings and retirement contributions etc.

The amount reflects the total amount of pay before any deductions of any type are withheld from the pay.

Whats gross pay. Chapter 3 of the Employers Guide to PAYE details the different types of pay that would be included. Gross pay often called gross wages is the total compensation earned by each employee. Gross pay can constitute the following.

Gross pay is the total amount of money that the employer pays in wages to an employee. The EPF in India is an employee-benefit scheme recommended by the Ministry of Labour which provides employees with an income during their retirement years. Deductions such as mandated taxes and Medicare contributions as well as deductions made for company health insurance or retirement funds are not accounted for when gross pay is calculated.

Gross pay is the amount an employee receives before any deductions and taxes. In other words gross pay is the total amount of money an employer agrees to pay an employee as their CTC cost to company or annual salary. If his employment is eligible for a Medicare deduction of 250 per week and a tax cut of 500 per week what is his gross wage.

Gross pay typically consists wages salaries commissions bonuses and any other type of earnings before taxes. In other words whatever an employee receives from employer as part of salary constitutes gross salary. Gross pay or gross salary is typically indicated as the amount a worker will make in a given year.

According to the Internal Revenue Service This includes all income you receive in the form of money goods property and services that is not exempt from tax. Besides the job may include 20 on tips and 30 on commissions. It includes the full amount of pay before any taxes or deductions.

Definition of Gross Pay. An employee has 2000 left every month after deductions. Hence weekly deductions are.

Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. Gross pay includes any overtime bonuses or reimbursements from an employer on top of regular hourly or salary pay. Gross pay or gross income is the amount of salary or wages paid to the individual by an employer before any taxes and deductions.

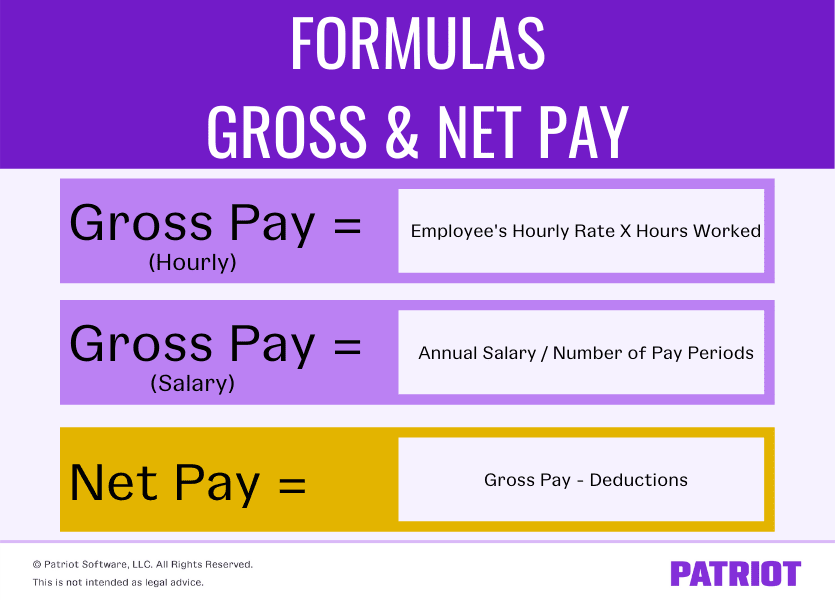

For example Dave joined a company as a software developer and his company agrees to pay him 240000 a year. Gross pay is the amount that workers are paid before any deductions that usually include bonuses commissions and tips are made. For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay.

Gross salary also called gross pay refers to pay components which an employee receives in return of his her service. The employees pay before any pension contributions or salary sacrifice deductions are made. It is the total amount of remuneration Remuneration Remuneration is any type of compensation or payment that an individual or employee receives as payment for their services or the work that they do for an organization or company.

Gross pay is the amount of wages or salary that is paid by an employer to an employee. Notice I didnt say it was the total amount paid to each employee. Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary.

Since there is a difference in the pay period unit we will take the lowest given pay period ie weekly rates. In other words Gross Salary is the amount paid before deduction of taxes or deductions and is inclusive of bonuses over-time pay holiday pay etc. What is Gross Pay.

Your gross income or pay is usually not the same as your net pay especially if you must pay for taxes and other benefits such as health insurance. Gross pay refers to the amount used to calculate the wages of an employee hourly or salary for the salaried employee. Also known as gross income gross pay represents the wages that an employee receives before taxes and deductions are withheld.

For example an individual who earns 5 an hour and works 30 hours his gross pay would be 150. Gross pay is the employees pay of any kind including. Gross pay is an individuals total earnings throughout a given period before any deductions are made.

These pay components are categorized as recurring and non recurring pay components. Taxable pay is your gross pay. Some people refer to this calculation as a unit rate conversion.

Gross pay is the amount paid before any deductions are withheld. Gross pay is the amount of money an employee earns for time they worked.

What Are Gross Wages Definition And Overview

What Are Gross Wages Definition And Overview

Gross Vs Net Pay What S The Difference

Gross Vs Net Pay What S The Difference

Difference Gross Pay And Net Pay Difference Between

Computing Gross Pay Page 1 Line 17qq Com

Computing Gross Pay Page 1 Line 17qq Com

What Is Net Pay Definition How To Calculate Video Lesson Transcript Study Com

What Is Net Pay Definition How To Calculate Video Lesson Transcript Study Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

The Difference Between Gross And Net Pay Economics Help

The Difference Between Gross And Net Pay Economics Help

Gross Pay Vs Net Pay A Small Business Guide The Blueprint

Gross Pay Vs Net Pay A Small Business Guide The Blueprint

Gross Vs Net Pay What S The Difference

Gross Vs Net Pay What S The Difference

Gross Pay Vs Net Pay What S The Difference Aps Payroll

Gross Pay Vs Net Pay What S The Difference Aps Payroll

:max_bytes(150000):strip_icc()/what-is-gross-pay-and-how-is-it-calculated-398696-v1-5bbd1ae146e0fb0026778399.png)

Comments

Post a Comment