What Is Collateral Protection Insurance

Collateral Protection Insurance It makes sense that the industrys best insurance tracking company would offer the best Collateral Protection Insurance CPI. What is Collateral Protection Insurance CPI.

Cpi Definition Collateral Protection Insurance Abbreviation Finder

Cpi Definition Collateral Protection Insurance Abbreviation Finder

Feel free to follow these links.

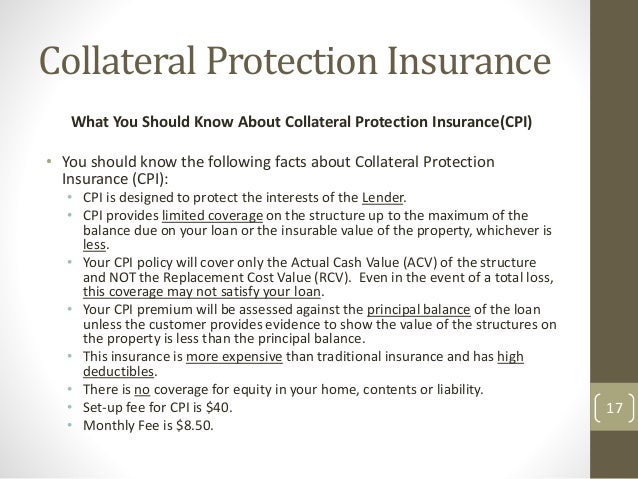

What is collateral protection insurance. It secures the lenders investment especially if the vehicle is totaled. If they are not able to provide evidence of insurance within seven days of signing the loan you can enforce the CPI addendum for your protection. Collateral protection insurance CPI is a type of car insurance imposed by lenders.

Simply put collateral protection insurance is coverage enacted by the auto lender to protect the vehicle if the borrower doesnt have sufficient coverage on the vehicle. It protects the lenders. Collateral protection insurance is used by lienholders to protect themselves against financial loss.

Normally when a borrower gets into a car accident their auto insurance covers the damages. Or Fails to insure the car adequately. Collateral Protection Insurance or CPI insures property for physical damage that is held as collateral for credit agreements loans and leases.

CPI is also known. Its part of the loan agreement that CPI will come into effect if you dont insure your car so theres no disputing its enforcement. Is a great place to start.

Because its insurance purchased by the lender its also known as lender-placed insurance. CPI insurance or force-placed insurance is issued on a vehicle when the borrower does not have the proper coverage. When borrows wont or cant obtain coverage Lender Placed Dual Interest Insurance is your safeguard against physical damage losses.

Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance. Your signed loan documents give Denver Community Credit Union the right to force-place CPI on your vehicle when coverage has lapsed. Collateral protection insurance or CPI is purchased or imposed by lending institutions to protect themselves from losses in the event the borrower to whom a loan was issued fails to carry insurance on the collateral used to secure the loan.

How does collateral protection insurance work. 1 Collateral means property pledged or used to secure payment repayment or performance under a credit or lease agreement including personal property real property fixtures inventory receivables rights or privileges. The most effective method for minimizing this risk is CPI.

Collateral Protection Insurance is lender-placed coverage on unsecured collateral which has no personal insurance policy. CPI covers the lenders if you damage the financed vehicle during the life of the loan and are uninsured. Best Of CPIVSI Providers.

Many insurance companies offer the solution for lenders which is collateral protection insurance. If you have financed or leased a vehicle then the lender will need to protect that vehicle the collateral with collateral protection insurance. Collateral protection insurance CPI.

Also known as lender-placed insurance collateral protection insurance requires your customer to maintain auto insurance throughout the life of the loan. Collateral Protection Insurance FULL COLLATERAL PROTECTION PLAN WITH TRACKING Our CPI or Collateral Protection Insurance program is designed to. What is Collateral Protection Insurance.

Collateral protection insurance CPI also known as forced car or lender-placed insurance is a policy that the lender can force on the motorist if he or she. Sometimes referred to as forced car insurance or lender-placed insurance collateral protection insurance is enacted when an individual who takes out an auto loan fails to adequately insure the vehicle and the. Fails to purchase auto insurance.

What Is Collateral Protection Insurance. A Complex Definition Made Simple When taking out an auto loan borrowers agree to maintain physical damage insurance on the vehicle naming the financial institution as an additional interest on the policy. If you dont maintain a current insurance policy your lender will pursue collateral protection insurance for your car.

2 Collateral protection insurance. Collateral Protection Insurance is coverage that protects against physical damage and protects the credit unions interest in your vehicle your loans collateral. What is collateral protection insurance.

What is collateral protection insurance.

Collateral Protection Insurance Can Drive Mass Adoption Of Token Economies By Etherisc Etherisc Blog

What Is Collateral Protection Insurance Cpi Insurance Verifacto

What Is Collateral Protection Insurance Cpi Insurance Verifacto

55 Fi Collateral Protection Insurance Youtube

55 Fi Collateral Protection Insurance Youtube

All You Need To Know About Collateral Protection Insurance By Jacob Mathew Issuu

All You Need To Know About Collateral Protection Insurance By Jacob Mathew Issuu

What Is Collateral Protection Insurance Verifacto

What Is Collateral Protection Insurance Verifacto

Collateral Protection Insurance Force Placed Auto Insurance Class Action

Collateral Protection Insurance Force Placed Auto Insurance Class Action

Attributes Of The Most Effective Cpi Programs

Attributes Of The Most Effective Cpi Programs

What Is Collateral Protection Insurance Cpi And How Does It Work

What Is Collateral Protection Insurance Cpi And How Does It Work

Products And Services Insurance Systems Inc

Cpi Collateral Protection Insurance By Acronymsandslang Com

Comments

Post a Comment